வரி பிடித்தம் செய்பவர் சரியாக TDS பதிவு செய்து Form 16 கொடுக்காவிட்டால் என்ன நடக்க வாய்ப்பு ? ஒரு பார்வை

வரி பிடித்தம் செய்பவர் சரியாக டிடிஎஸ் TDS பைல் பண்ண வில்லை என்றால் என்ன நடக்க வாய்ப்பு உள்ளது ? சிறைதண்டனை வாய்பா ?ஒரு பார்வை ! !!!!!!!!

சந்தேகத்திற்கு விளக்கம் மட்டுமே!!!!!

மற்றும் INCOME TAX அலுவலக முகவரி கீழே முகவரி

Click to download1

Click download 2

AND TAXGURU SITE SAYS BELOW

TaxGuru

HomepageIncome Tax

mayankmohanka

1 year ago

Income Tax Prosecution Provision u/s 276B needs a review

Revenue Authorities must review this existing stringent provision u/s 276B of the Income Tax Act and must consider doing appropriate modifications/changes in it so as to enable an effective action against the willful and habitual tax evaders only and not against the bonafide assessees who create wealth for the Nation.

Subscribe to updates

Mayank Mohanka

Review of the Existing Prosecution Provision u/s 276B of Income Tax Act, 1961- Need of the Hour to Take Taxpayer Friendly Initiative

Legislature, by the insertion of Chapter XVII-B in the Income Tax Act, 1961, has casted the responsibility of deducting and depositing Tax at Source (TDS) in relation to the income of the recipient, upon the payer of such income and as such the statutory onus and burden of the Exchequer has been shifted to the payer of income who happens to be an assessee. In the FY 2015-16, TDS constituted approximately 42 % of the nett. income tax collections and 36% of the gross income tax collections. Pre-Assessment Tax Collection Measures in the form of TDS, Advance Tax and Self Assessment Tax constituted approximately 85% of the gross income tax collections of Rs 8.64 lakh crores. Interestingly, for discharging this statutory responsibility of the Exchequer, the assessee does not get rewarded in any manner. In-fact to the contrary, a failure or default in discharge of this burden, even an unintentional one, results in some very dire consequences including prosecution also.

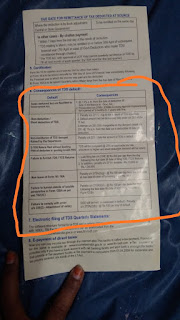

Section 276B of the Income Tax Act, 1961, providing for the prosecution provision in case of default in payment of TDS under Chapter XVII-B and Chapter XII-D, was inserted by the Finance Act, 1968, for the first time by the legislature.

The text of section 276B as inserted by the Finance Act, 1968 is reproduced as under:

“276B. If a person, without reasonable cause or excuse, fails to deduct or after deducting fails to pay the tax as required by or under the provisions of sub-section (9) of section 80E or Chapter XVII-B, he shall be punishable with rigorous imprisonment for a term which may extend to six months, and shall also be liable to fine which shall be not less than a sum calculated at the rate of fifteen per cent per annum on the amount of such tax from the date on which such tax was deductible to the date on which such tax is actually paid].”

The provisions of section 276B of the Income Tax Act, have undergone multiple changes since last 5 decades and presently this section as per Finance Act 2017, reads as under:

“276B. If a person fails to pay to the credit of the Central Government, the tax deducted at source by him as required by or under the provisions of Chapter XVII-B, he shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years and with fine.”

The journey which this section 276B of the Income Tax Act, 1961 has transcended over the last 5 decades is clearly not in favor of the assessee and is not taxpayer friendly.

A perusal of the afore-stated legal position as enshrined u/s 276B, at two points of time i.e. at the time of its insertion in 1968 and at present in 2017, makes it abundantly clear that this provision has been made more stringent and more harsh with the passage of time.

This is evident as under:

(i) the expression “without reasonable cause or excuse” which was very much an integral part of the section at the time of its insertion in 1968, and is in line with the cardinal principal of equity, justice and good conscience has altogether been omitted at present.

(ii) the maximum tenure of imprisonment has been increased from 6 months to 7 years.

However, there is a non obstante provision as contained in section 278AA of the Income Tax Act, 1961, which clearly provides that no person shall be punishable for any failure referred to in section 276B if he proves that there was a reasonable cause for such failure.

There is a well known maxim which goes as “with great power comes greater responsibility.” The Power to Prosecute must be used judiciously, rationally and with due application of mind to meet the ends of justice.

The prosecution for default in paying TDS to the credit of the Central Government did not automatically follow such default and the provision had, therefore, been made under Section 279 of the Income-tax Act for sanction to be granted for such prosecution by the Chief Commissioner. It had repeatedly been held by the courts that whenever the decision was left to the subjective satisfaction of a statutory authority, it necessarily implied that such authority was required to apply its mind to all relevant factors before arriving at a decision. The grant of sanction for launching prosecution is a very serious & extreme measure having serious consequences which entailed proper exercise of discretion upon consideration of all relevant materials, including mitigating circumstances in favor of the defaulter.

However, unfortunately, the present day tendency has become to put undue pressure for tax collections for meeting out budgetary targets for improving service records, by using the window of prosecution. This was clearly not the Legislative Intent behind insertion of Prosecution Provisions in the Income Tax Act, 1961.

Surprisingly and Shockingly, the Current Legal Provisions and the CBDT guidelines, w.r.t. section 276B of the Income Tax Act, concerning the default in payment of TDS in time, entails very serious and harsh consequences. Presently, there are numerous instances, where even for a delay of 2-3 months in depositing the TDS with the Exchequer, Prosecution Proceedings u/s 276B are being launched. This high handed approach is clearly not justifiable and desirable.

The present framework of law in the context of section 276B of the Income Tax Act, treats every assessee who has defaulted in payment of TDS, on equal footing, irrespective of the severity of default. This is totally unwarranted and uncalled for.

For judicious, equitable and effective implementation of the Prosecution Provision u/s 276B of the Income Tax Act, first and foremost, the defaulters must be categorized into different categories based on the nature and severity of default in terms of quantum, duration and intent parameters and depending upon the severity of the default, the penal consequences must follow.

In making these categorizations, the element of subjectivity within the categorization must be altogether done away with. Instead the entire categorization exercise must be standardized as is being done in Computer Assisted Scrutiny Selection (CASS).

In determining the categorization of defaulters, the status of pendency or otherwise of the regular undisputed income- tax refund of the defaulter assessee deserves to be given a significant and major consideration.

This can be better explained in terms of 2 Hypothetical Scenarios as under:

Scenario 1. An assessee X, defaults in deposition of TDS amounting to Rs 20 Lacs, and even after the lapse of more than 12 months, he has not deposited the principal TDS amount as well as the penal interest. No income tax refund is pending in his PAN.

Scenario 2. An assessee Y, defaults in deposition of TDS amounting to Rs 20 Lacs. He deposits the principal TDS amount as well as the penal interest @ 1.5% per month after a delay of 6 months. However, his regular undisputed income-tax refund of more than Rs. 20 Lacs or much more than Rs. 20.00 Lacs is also pending with the Exchequer, and it remains pending through-out the period of default in payment of TDS by him and thereafter.

In this case, assessee X in scenario 1 is obviously a willful defaulter and appropriate penal actions against him are warranted.

However, the question arises in the case of assessee Y in scenario 2. Whether it will be justifiable or rational to consider assessee Y as an assessee in default u/s 201 and whether it is lawful to launch prosecution proceedings u/s 276B against him. Going by the true legislative intent and the dictum of principle of natural justice, the answer shall be “NO” only. This is because, in real and effective terms, at no point of time, there is outstanding income-tax demand against assessee Y. The TDS demand of assessee Y can very easily be adjusted against his pending regular income-tax refund and so assessee Y must not be considered as an assessee in default and the question of launching of prosecution proceedings against assessee Y must not arise, more so when he has paid the principal TDS along with the penal interest @ 1.5% per month, whereas he is entitled for a comparatively very less interest on his income-tax refund @ 0.5% per month only.

The afore-stated hypothetical scenario 2, ironically reflects the clearly evident lack of level playing field for the assessee. This is so because, if there is some default in payment of TDS in time by the assessee, he is liable to pay penal interest @ 1.5% per month and also suffers the dis allowance of corresponding expenditure in computation of his taxable income. To add to that, he is also exposed to prosecution u/s 276B of the Income Tax Act and to avoid that the assessee is forced to apply for compounding wherein he is supposed to pay additional interest @ 3% per month along with the applicable compounding charges.

As opposed to this, if there is a delay in granting the income-tax refund by the Exchequer to the assessee, all he can hope for is a compensating interest @ 0.5% per month and that too after a lot of follow-up and litigation. There is no provision in Law for compounding against the Exchequer. No prosecution can be launched against the Exchequer and unlike the assessee, the Exchequer can’t be considered as an Exchequer in default.

There are cases, where the outstanding income-tax refund of the assessee is 3-4 times as that of his TDS liability. In such cases, the delay in granting the due income tax refund to the assessee impacts the business & the financial capability of the assessee very severely & adversely & also results in the credit facilities of the assessee becoming NPAs much to the detriment of the Exchequer as well as the assessee. In such cases, it would not be wrong to contend that the assessee’s inability to deposit the TDS in time, is primarily because the Exchequer has not provided his due income tax refund. In such cases, even if the Exchequer launches prosecution, it is not likely to sustain in the Court of Law & rather it will be difficult for the Exchequer to defend its own delay in granting refund of income tax to the assessee.

In order to restore some balance, atleast in cases where there is default in payment of TDS but simultaneously the regular income-tax refund is also pending in the name of the assessee, then the assessee must be given an option to get its outstanding TDS demand adjusted against its pending income tax refund and this will enable the recipient of income also to obtain his TDS credit in time. Currently, even after penalizing the deductor for his default in deposition of TDS by way of levy of penal interest @ 1.5% per month and dis allowance of the corresponding expenditure and further more by subjecting him to compounding @ 3% per month in lieu of launching prosecution proceedings u/s 276B, no credit of TDS is being made available to the recipient of income. Thus, in true spirit, the whole purpose of subjecting the deductor to all these stringent repercussions gets defeated.

Furthermore, the online Form 26AS in which the credit of TDS being deducted from the income of the recipient, is reflected, instead of serving as a taxpayer friendly initiative, is infact causing undue hardship to the recipient of income. This is because, currently there are numerous instances where due to the inherent processing deficiencies in this online system, the TDS credit does not get reflected even after the same has been deposited by the deductor and the deductee gets deprived of his lawful TDS credit. Unfortunately, currently the non reflection of even the duly deducted and deposited TDS in online Form 26AS, is being used as a blanket excuse for not giving the fully lawful TDS credit. Before the induction of this online system, based on the manual TDS certificates, the deductee was atleast able to claim his otherwise lawful TDS credit. The vigour, aggressiveness and willingness as shown by the Exchequer in penalizing the Tax Deductor must also be reflected in giving hindrance free TDS credit to the deductee.

All what is required is a proper co-ordination between the TDS Wing and the Assessment Wing of the Exchequer and the removal of the procedural bottlenecks and streamlining of the functional capacities of the Exchequer. Currently u/s 245 of the Income Tax Act, the outstanding income tax demand of the assessee is being adjusted against his income tax refund. The same must also apply to the adjustment of the pending TDS demand as reflected in Traces against income tax refund. This will lead to the much needed avoidance of undue hardship to both the payer of income and recipient of income. Also, it will result in substantial reduction in the administrative work-load of the Exchequer and will enable it to direct its time and energy in harnessing tax revenues in a more efficient and productive manner.

An assessee who has deposited the deducted TDS with penal interest and has filed the TDS Returns, must not be considered as a defaulter anymore. He can’t be equated with a Tax Evader. Thousands of such prosecution notices are being sent by the Exchequer to the Business Community across the country w.e.f. FY 12-13. There are thousands of cases, wherein the harassment of Law abiding assessees, becomes clearly evident. Even the Exchequer is also being burdened un-necessarily.

Therefore, keeping in view the above, the concerned Revenue Authorities must review this existing stringent provision u/s 276B of the Income Tax Act and must consider doing appropriate modifications/changes in it so as to enable an effective action against the willful and habitual tax evaders only and not against the bonafide assessees who create wealth for the Nation. Then in true spirit, the Government’s Objective of enabling and facilitating Ease of Doing Business will be accomplished.

(The author can be reached at mayankmohanka@gmail.com)

Section 4(b) of Sick Industrial Companies (Special Provisions) Repeal Act, 2003 is constitutionally valid: HC » « ITAT confirms Addition to Income of Priyanka Chopra

Categories: Income Tax

View Comments (4)

Sekaran says: January 28, 2018 at 11:15 am

The article is very long.

Actually The India Post is one of the major bodies which is still not properly organized to act efficiently. The tax dedn for the Q4 is never deducted by them.The onus is transferred to the customer. Is that justified? It is certainly not a great convenience to the public. Instead the senior citizens responsibility! Why this laxity granted to a govt body?

pradeep says: January 28, 2018 at 5:13 pm

all the tax professionals should ask govt to change the sec 276B to penalty of TDS not deducted by the deductor along with details of deductees so that while deductor is punished for his default, department is furnished the details of parties who might have concealed their income particulars as well. so if tds defaults are made good as deductors financial liability only whether or not he collects from parties like sales tax, it will increase revenue and govt will be able to capture defaulters

Vijay EngineersVijay Kumar says: January 29, 2018 at 7:42 am

Panelising is a negative thinking. Government has a right to get Income Tax, but panelising is no way. Even if Penalisuing is required, it should be very minimal. In Income Tax law, non filing of TDS and TCS returns attracts Rs. 200/- per day as Late Filing Fees or Penalty. Does this sound OK? No interest is chargeable/payable for 10% of the Income Tax, what to talk of the Late filing charges. GOVERNMENT SHOULD CONSIDER THESE NEGATIVE RULES.

Abhinandan Jain says: August 30, 2018 at 7:05 pm

What will be remedy handling prosecution Notice if the TDS default has been paid along with Interest and even excess in comparison to what the dept is demanding.Whether such prosecution proceeding to be concluded only by compounding u/s 279 (2) or there is another remedy for this.(Talking about 1st time offence)

சந்தேகத்திற்கு விளக்கம் மட்டுமே!!!!!

மற்றும் INCOME TAX அலுவலக முகவரி கீழே முகவரி

Click to download1

Click download 2

AND TAXGURU SITE SAYS BELOW

TaxGuru

HomepageIncome Tax

mayankmohanka

1 year ago

Income Tax Prosecution Provision u/s 276B needs a review

Revenue Authorities must review this existing stringent provision u/s 276B of the Income Tax Act and must consider doing appropriate modifications/changes in it so as to enable an effective action against the willful and habitual tax evaders only and not against the bonafide assessees who create wealth for the Nation.

Subscribe to updates

Mayank Mohanka

Review of the Existing Prosecution Provision u/s 276B of Income Tax Act, 1961- Need of the Hour to Take Taxpayer Friendly Initiative

Legislature, by the insertion of Chapter XVII-B in the Income Tax Act, 1961, has casted the responsibility of deducting and depositing Tax at Source (TDS) in relation to the income of the recipient, upon the payer of such income and as such the statutory onus and burden of the Exchequer has been shifted to the payer of income who happens to be an assessee. In the FY 2015-16, TDS constituted approximately 42 % of the nett. income tax collections and 36% of the gross income tax collections. Pre-Assessment Tax Collection Measures in the form of TDS, Advance Tax and Self Assessment Tax constituted approximately 85% of the gross income tax collections of Rs 8.64 lakh crores. Interestingly, for discharging this statutory responsibility of the Exchequer, the assessee does not get rewarded in any manner. In-fact to the contrary, a failure or default in discharge of this burden, even an unintentional one, results in some very dire consequences including prosecution also.

Section 276B of the Income Tax Act, 1961, providing for the prosecution provision in case of default in payment of TDS under Chapter XVII-B and Chapter XII-D, was inserted by the Finance Act, 1968, for the first time by the legislature.

The text of section 276B as inserted by the Finance Act, 1968 is reproduced as under:

“276B. If a person, without reasonable cause or excuse, fails to deduct or after deducting fails to pay the tax as required by or under the provisions of sub-section (9) of section 80E or Chapter XVII-B, he shall be punishable with rigorous imprisonment for a term which may extend to six months, and shall also be liable to fine which shall be not less than a sum calculated at the rate of fifteen per cent per annum on the amount of such tax from the date on which such tax was deductible to the date on which such tax is actually paid].”

The provisions of section 276B of the Income Tax Act, have undergone multiple changes since last 5 decades and presently this section as per Finance Act 2017, reads as under:

“276B. If a person fails to pay to the credit of the Central Government, the tax deducted at source by him as required by or under the provisions of Chapter XVII-B, he shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years and with fine.”

The journey which this section 276B of the Income Tax Act, 1961 has transcended over the last 5 decades is clearly not in favor of the assessee and is not taxpayer friendly.

A perusal of the afore-stated legal position as enshrined u/s 276B, at two points of time i.e. at the time of its insertion in 1968 and at present in 2017, makes it abundantly clear that this provision has been made more stringent and more harsh with the passage of time.

This is evident as under:

(i) the expression “without reasonable cause or excuse” which was very much an integral part of the section at the time of its insertion in 1968, and is in line with the cardinal principal of equity, justice and good conscience has altogether been omitted at present.

(ii) the maximum tenure of imprisonment has been increased from 6 months to 7 years.

However, there is a non obstante provision as contained in section 278AA of the Income Tax Act, 1961, which clearly provides that no person shall be punishable for any failure referred to in section 276B if he proves that there was a reasonable cause for such failure.

There is a well known maxim which goes as “with great power comes greater responsibility.” The Power to Prosecute must be used judiciously, rationally and with due application of mind to meet the ends of justice.

The prosecution for default in paying TDS to the credit of the Central Government did not automatically follow such default and the provision had, therefore, been made under Section 279 of the Income-tax Act for sanction to be granted for such prosecution by the Chief Commissioner. It had repeatedly been held by the courts that whenever the decision was left to the subjective satisfaction of a statutory authority, it necessarily implied that such authority was required to apply its mind to all relevant factors before arriving at a decision. The grant of sanction for launching prosecution is a very serious & extreme measure having serious consequences which entailed proper exercise of discretion upon consideration of all relevant materials, including mitigating circumstances in favor of the defaulter.

However, unfortunately, the present day tendency has become to put undue pressure for tax collections for meeting out budgetary targets for improving service records, by using the window of prosecution. This was clearly not the Legislative Intent behind insertion of Prosecution Provisions in the Income Tax Act, 1961.

Surprisingly and Shockingly, the Current Legal Provisions and the CBDT guidelines, w.r.t. section 276B of the Income Tax Act, concerning the default in payment of TDS in time, entails very serious and harsh consequences. Presently, there are numerous instances, where even for a delay of 2-3 months in depositing the TDS with the Exchequer, Prosecution Proceedings u/s 276B are being launched. This high handed approach is clearly not justifiable and desirable.

The present framework of law in the context of section 276B of the Income Tax Act, treats every assessee who has defaulted in payment of TDS, on equal footing, irrespective of the severity of default. This is totally unwarranted and uncalled for.

For judicious, equitable and effective implementation of the Prosecution Provision u/s 276B of the Income Tax Act, first and foremost, the defaulters must be categorized into different categories based on the nature and severity of default in terms of quantum, duration and intent parameters and depending upon the severity of the default, the penal consequences must follow.

In making these categorizations, the element of subjectivity within the categorization must be altogether done away with. Instead the entire categorization exercise must be standardized as is being done in Computer Assisted Scrutiny Selection (CASS).

In determining the categorization of defaulters, the status of pendency or otherwise of the regular undisputed income- tax refund of the defaulter assessee deserves to be given a significant and major consideration.

This can be better explained in terms of 2 Hypothetical Scenarios as under:

Scenario 1. An assessee X, defaults in deposition of TDS amounting to Rs 20 Lacs, and even after the lapse of more than 12 months, he has not deposited the principal TDS amount as well as the penal interest. No income tax refund is pending in his PAN.

Scenario 2. An assessee Y, defaults in deposition of TDS amounting to Rs 20 Lacs. He deposits the principal TDS amount as well as the penal interest @ 1.5% per month after a delay of 6 months. However, his regular undisputed income-tax refund of more than Rs. 20 Lacs or much more than Rs. 20.00 Lacs is also pending with the Exchequer, and it remains pending through-out the period of default in payment of TDS by him and thereafter.

In this case, assessee X in scenario 1 is obviously a willful defaulter and appropriate penal actions against him are warranted.

However, the question arises in the case of assessee Y in scenario 2. Whether it will be justifiable or rational to consider assessee Y as an assessee in default u/s 201 and whether it is lawful to launch prosecution proceedings u/s 276B against him. Going by the true legislative intent and the dictum of principle of natural justice, the answer shall be “NO” only. This is because, in real and effective terms, at no point of time, there is outstanding income-tax demand against assessee Y. The TDS demand of assessee Y can very easily be adjusted against his pending regular income-tax refund and so assessee Y must not be considered as an assessee in default and the question of launching of prosecution proceedings against assessee Y must not arise, more so when he has paid the principal TDS along with the penal interest @ 1.5% per month, whereas he is entitled for a comparatively very less interest on his income-tax refund @ 0.5% per month only.

The afore-stated hypothetical scenario 2, ironically reflects the clearly evident lack of level playing field for the assessee. This is so because, if there is some default in payment of TDS in time by the assessee, he is liable to pay penal interest @ 1.5% per month and also suffers the dis allowance of corresponding expenditure in computation of his taxable income. To add to that, he is also exposed to prosecution u/s 276B of the Income Tax Act and to avoid that the assessee is forced to apply for compounding wherein he is supposed to pay additional interest @ 3% per month along with the applicable compounding charges.

As opposed to this, if there is a delay in granting the income-tax refund by the Exchequer to the assessee, all he can hope for is a compensating interest @ 0.5% per month and that too after a lot of follow-up and litigation. There is no provision in Law for compounding against the Exchequer. No prosecution can be launched against the Exchequer and unlike the assessee, the Exchequer can’t be considered as an Exchequer in default.

There are cases, where the outstanding income-tax refund of the assessee is 3-4 times as that of his TDS liability. In such cases, the delay in granting the due income tax refund to the assessee impacts the business & the financial capability of the assessee very severely & adversely & also results in the credit facilities of the assessee becoming NPAs much to the detriment of the Exchequer as well as the assessee. In such cases, it would not be wrong to contend that the assessee’s inability to deposit the TDS in time, is primarily because the Exchequer has not provided his due income tax refund. In such cases, even if the Exchequer launches prosecution, it is not likely to sustain in the Court of Law & rather it will be difficult for the Exchequer to defend its own delay in granting refund of income tax to the assessee.

In order to restore some balance, atleast in cases where there is default in payment of TDS but simultaneously the regular income-tax refund is also pending in the name of the assessee, then the assessee must be given an option to get its outstanding TDS demand adjusted against its pending income tax refund and this will enable the recipient of income also to obtain his TDS credit in time. Currently, even after penalizing the deductor for his default in deposition of TDS by way of levy of penal interest @ 1.5% per month and dis allowance of the corresponding expenditure and further more by subjecting him to compounding @ 3% per month in lieu of launching prosecution proceedings u/s 276B, no credit of TDS is being made available to the recipient of income. Thus, in true spirit, the whole purpose of subjecting the deductor to all these stringent repercussions gets defeated.

Furthermore, the online Form 26AS in which the credit of TDS being deducted from the income of the recipient, is reflected, instead of serving as a taxpayer friendly initiative, is infact causing undue hardship to the recipient of income. This is because, currently there are numerous instances where due to the inherent processing deficiencies in this online system, the TDS credit does not get reflected even after the same has been deposited by the deductor and the deductee gets deprived of his lawful TDS credit. Unfortunately, currently the non reflection of even the duly deducted and deposited TDS in online Form 26AS, is being used as a blanket excuse for not giving the fully lawful TDS credit. Before the induction of this online system, based on the manual TDS certificates, the deductee was atleast able to claim his otherwise lawful TDS credit. The vigour, aggressiveness and willingness as shown by the Exchequer in penalizing the Tax Deductor must also be reflected in giving hindrance free TDS credit to the deductee.

All what is required is a proper co-ordination between the TDS Wing and the Assessment Wing of the Exchequer and the removal of the procedural bottlenecks and streamlining of the functional capacities of the Exchequer. Currently u/s 245 of the Income Tax Act, the outstanding income tax demand of the assessee is being adjusted against his income tax refund. The same must also apply to the adjustment of the pending TDS demand as reflected in Traces against income tax refund. This will lead to the much needed avoidance of undue hardship to both the payer of income and recipient of income. Also, it will result in substantial reduction in the administrative work-load of the Exchequer and will enable it to direct its time and energy in harnessing tax revenues in a more efficient and productive manner.

An assessee who has deposited the deducted TDS with penal interest and has filed the TDS Returns, must not be considered as a defaulter anymore. He can’t be equated with a Tax Evader. Thousands of such prosecution notices are being sent by the Exchequer to the Business Community across the country w.e.f. FY 12-13. There are thousands of cases, wherein the harassment of Law abiding assessees, becomes clearly evident. Even the Exchequer is also being burdened un-necessarily.

Therefore, keeping in view the above, the concerned Revenue Authorities must review this existing stringent provision u/s 276B of the Income Tax Act and must consider doing appropriate modifications/changes in it so as to enable an effective action against the willful and habitual tax evaders only and not against the bonafide assessees who create wealth for the Nation. Then in true spirit, the Government’s Objective of enabling and facilitating Ease of Doing Business will be accomplished.

(The author can be reached at mayankmohanka@gmail.com)

Section 4(b) of Sick Industrial Companies (Special Provisions) Repeal Act, 2003 is constitutionally valid: HC » « ITAT confirms Addition to Income of Priyanka Chopra

Categories: Income Tax

View Comments (4)

Sekaran says: January 28, 2018 at 11:15 am

The article is very long.

Actually The India Post is one of the major bodies which is still not properly organized to act efficiently. The tax dedn for the Q4 is never deducted by them.The onus is transferred to the customer. Is that justified? It is certainly not a great convenience to the public. Instead the senior citizens responsibility! Why this laxity granted to a govt body?

pradeep says: January 28, 2018 at 5:13 pm

all the tax professionals should ask govt to change the sec 276B to penalty of TDS not deducted by the deductor along with details of deductees so that while deductor is punished for his default, department is furnished the details of parties who might have concealed their income particulars as well. so if tds defaults are made good as deductors financial liability only whether or not he collects from parties like sales tax, it will increase revenue and govt will be able to capture defaulters

Vijay EngineersVijay Kumar says: January 29, 2018 at 7:42 am

Panelising is a negative thinking. Government has a right to get Income Tax, but panelising is no way. Even if Penalisuing is required, it should be very minimal. In Income Tax law, non filing of TDS and TCS returns attracts Rs. 200/- per day as Late Filing Fees or Penalty. Does this sound OK? No interest is chargeable/payable for 10% of the Income Tax, what to talk of the Late filing charges. GOVERNMENT SHOULD CONSIDER THESE NEGATIVE RULES.

Abhinandan Jain says: August 30, 2018 at 7:05 pm

What will be remedy handling prosecution Notice if the TDS default has been paid along with Interest and even excess in comparison to what the dept is demanding.Whether such prosecution proceeding to be concluded only by compounding u/s 279 (2) or there is another remedy for this.(Talking about 1st time offence)

Failure to pay the tax collected at source

"276BB. If a person fails to pay to the credit of the Central Government, the tax collected by him as required under the provisions of section 206C, he shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years and with fine.".

Comments

Post a Comment